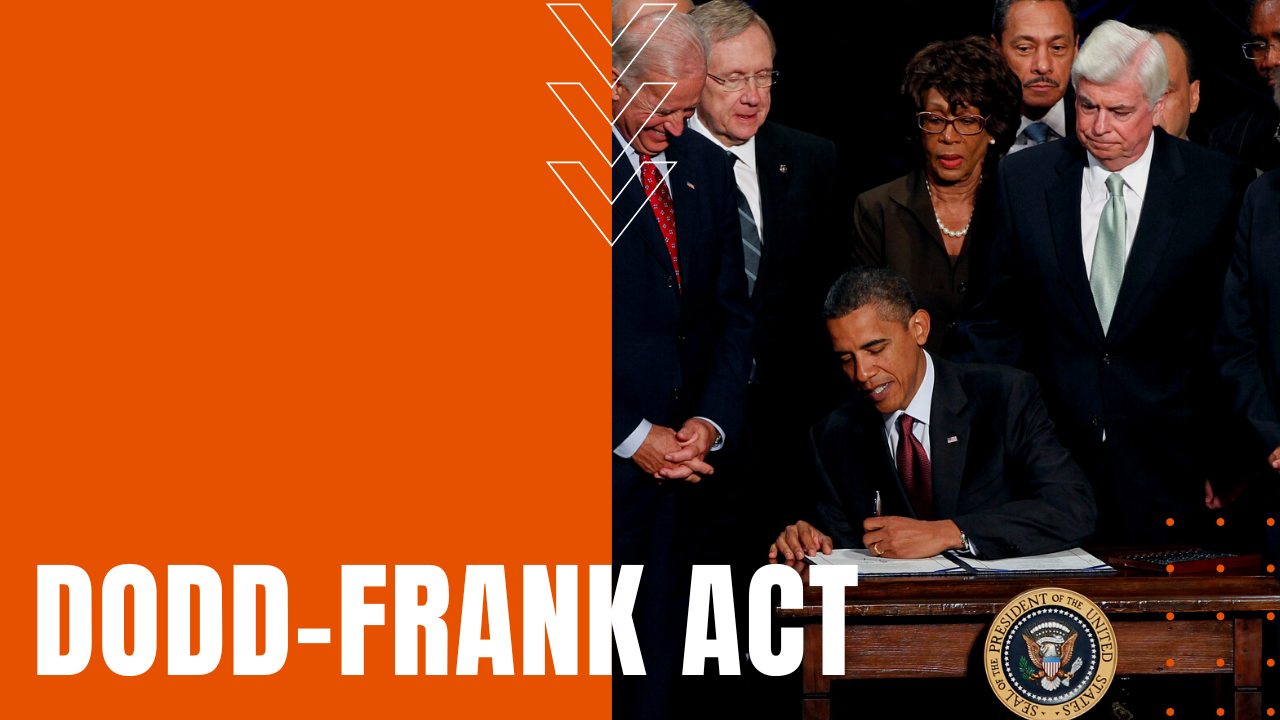

Dodd-Frank Act

After years of improper regulation by federal banking oversight agencies, the deceptive practice of bundling sub-prime and prime debt obligations into mortgage-backed securities resulted in a cascading, domino-like failure throughout Wall Street and world economies, leading to what is now known as the Great Recession.

Housing Collapse Begins

During its buildup to disaster, powerful Wall Street banks began to feel the pinch of a collapsing American housing market, prompted by a staggering rise in foreclosures caused by lending practices that gave high-dollar home loans to unqualified borrowers. The downward spiral reached its peak in September of 2008, when Lehman Brothers—the fourth largest investment bank in the United States—collapsed under the weight of an insurmountable bad debt crisis.

Aftermath of Great Recession

In the aftermath of the Great Recession, in 2010, President Barack Obama signed into law the Dodd-Frank Wall Street Reform and Consumer Protection Act—otherwise known as Dodd-Frank—in an effort to protect American consumers from future abusive and unethical practices by American mortgage lenders, as well as a vast array of restrictions placed on Wall Street.

Echoes of the Great Depression

Spearheaded by Senator Chris Dodd of Connecticut and Representative Barney Frank of Massachusetts, the bill represents the federal government’s most substantial financial reform legislation since the Glass-Steagall Act that resulted from the Great Depression. Dodd-Frank includes hundreds of pages of legislation imposing reforms on 16 major areas of banking and Wall Street practices, including an increase in the amount of money a bank is required to hold in reserve in anticipation of future economic downturns,

Annual Stress Test For Big Banks

while banks with assets greater than $50 billion now undergo an annual stress test by the Federal Reserve, designed to challenge a bank’s survivability in a simulated financial crisis. Dodd-Frank also created several new federal oversight agencies intended to protect consumers and prevent another mass failure like the Great Recession, while the later Volcker Rule amendment forbids banks from making certain investments within their own accounts, making Dodd-Frank, a still hotly-debated safety net for the American consumer.